Understanding Bitcoin Stock On Fintechzoom.com: Insights, Trends, And Predictions

Introduction

In the rapidly evolving world of finance, understanding the dynamics of digital currencies has become essential for modern investors. Bitcoin, often referred to as "bitcoin stock," is not a traditional stock but rather a cryptocurrency that exhibits characteristics similar to stocks, such as high liquidity and price volatility. Platforms like fintechzoom.com have emerged as valuable tools for investors seeking insights into the cryptocurrency market. This article explores the concept of bitcoin stock, the role of fintechzoom.com in tracking its price, and the factors influencing its valuation.

What is Bitcoin Stock?

Bitcoin stock refers to shares of companies or investment vehicles that are directly or indirectly connected to Bitcoin. These can include:

- Companies involved in Bitcoin mining

- Exchanges facilitating cryptocurrency trading

- Financial technology (fintech) firms offering blockchain-based services

While Bitcoin itself is not a stock in the traditional sense, its high liquidity and price volatility have led many investors to treat it as such. This makes it crucial for anyone trading Bitcoin or investing in digital currencies to closely monitor its price movements.

The Role of Fintechzoom.com in Bitcoin Analysis

Comprehensive Financial Insights

Fintechzoom.com is a dedicated platform for cryptocurrency enthusiasts, offering valuable insights and resources to navigate the complex ecosystem of digital currencies. The site provides:

- Comprehensive financial news, analysis, and insights across various sectors, including stocks, cryptocurrencies, and fintech

- Expert analysis on stock market trends, such as the DAX 40 index in Germany

- Updates on cryptocurrency regulations and economic news, like interest rate changes

This analysis helps traders and investors make informed decisions, ensuring they stay ahead of the curve in a fast-paced market.

Tracking Bitcoin Price Movements

Fintechzoom excels in offering tools and resources to track Bitcoin's price. For instance:

- Vegamoviesfoo

- Whitney Wisconsin Death

- Mkvmoviespoint All Quality And Hindi Dubbed Download

- Is Luke Bryan A Democrat Or A Republican

- Nsfw Tiktok

- Real-time price updates for Bitcoin and other cryptocurrencies

- Historical data and charts to analyze long-term trends

- Alerts for significant price levels, helping investors decide when to buy or sell

For example, Bitcoin hit a record high of $111,886.41 on May 22, but it gave up some of its gains in the final week of May. Platforms like fintechzoom.com ensure investors are aware of these fluctuations, allowing them to make timely decisions.

Factors Influencing Bitcoin's Valuation

Several factors influence Bitcoin's price and valuation. These include:

1. Stock Market Trends

Traditional stock market trends can impact Bitcoin's price. For instance, changes in the DAX 40 index or other major indices might reflect broader economic conditions that affect investor sentiment toward cryptocurrencies.

2. Cryptocurrency Updates

New regulations or developments in the cryptocurrency space can significantly influence Bitcoin's price. For example, updates on Bitcoin mining regulations or the introduction of new blockchain technologies can cause price volatility.

3. Economic News

Economic news, such as interest rate changes or inflation reports, can also affect Bitcoin's valuation. Investors often view Bitcoin as a hedge against inflation, so economic indicators are closely monitored.

4. Decentralized Finance (DeFi)

The rise of decentralized finance (DeFi) has added another layer of complexity to the cryptocurrency market. DeFi platforms offer innovative financial services without traditional intermediaries, influencing how investors perceive the value of Bitcoin and other digital currencies.

Expert Predictions and Market Analysis

In this article on fintechzoom, we provide a complete analysis of Bitcoin's price, including current market conditions, factors influencing its valuation, and expert predictions for the future. Some key points include:

- Bitcoin's strength above $100,000 indicates a bullish trend, but investors should remain cautious of short-term volatility.

- Experts predict that Bitcoin's price will continue to fluctuate based on regulatory changes, technological advancements, and macroeconomic factors.

- Fintechzoom offers tools to monitor price fluctuations, helping investors identify significant price levels that could trigger buying or selling decisions.

For instance, whether it's Bitcoin's average price or fintechzoom's analysis of Amazon stock, significant price levels are always directly accessible. This ensures investors can make data-driven decisions.

Why Stay Updated with Fintechzoom?

As the cryptocurrency market continues to evolve, staying updated with reliable predictions is crucial for maximizing returns and mitigating risks. Fintechzoom.com offers:

- Latest trends in Bitcoin, Ethereum, and altcoins

- Market analyses and price movements

- Impact of decentralized finance (DeFi) on the broader financial ecosystem

By following these updates, investors can better understand the forces driving the cryptocurrency market and position themselves for success.

Conclusion

In conclusion, understanding Bitcoin stock and its dynamics is essential for anyone involved in the cryptocurrency market. Platforms like fintechzoom.com play a critical role in providing comprehensive insights, real-time data, and expert analysis to help investors navigate this exciting ecosystem. By monitoring factors such as stock market trends, cryptocurrency updates, and economic news, investors can make informed decisions and capitalize on opportunities in the ever-changing world of digital currencies.

This article has explored the concept of Bitcoin stock, the role of fintechzoom.com in tracking its price, and the factors influencing its valuation. As the market continues to evolve, staying updated with reliable information and predictions will remain key to achieving success in the cryptocurrency space.

Home - FINTECHZOOM

Home - FINTECHZOOM

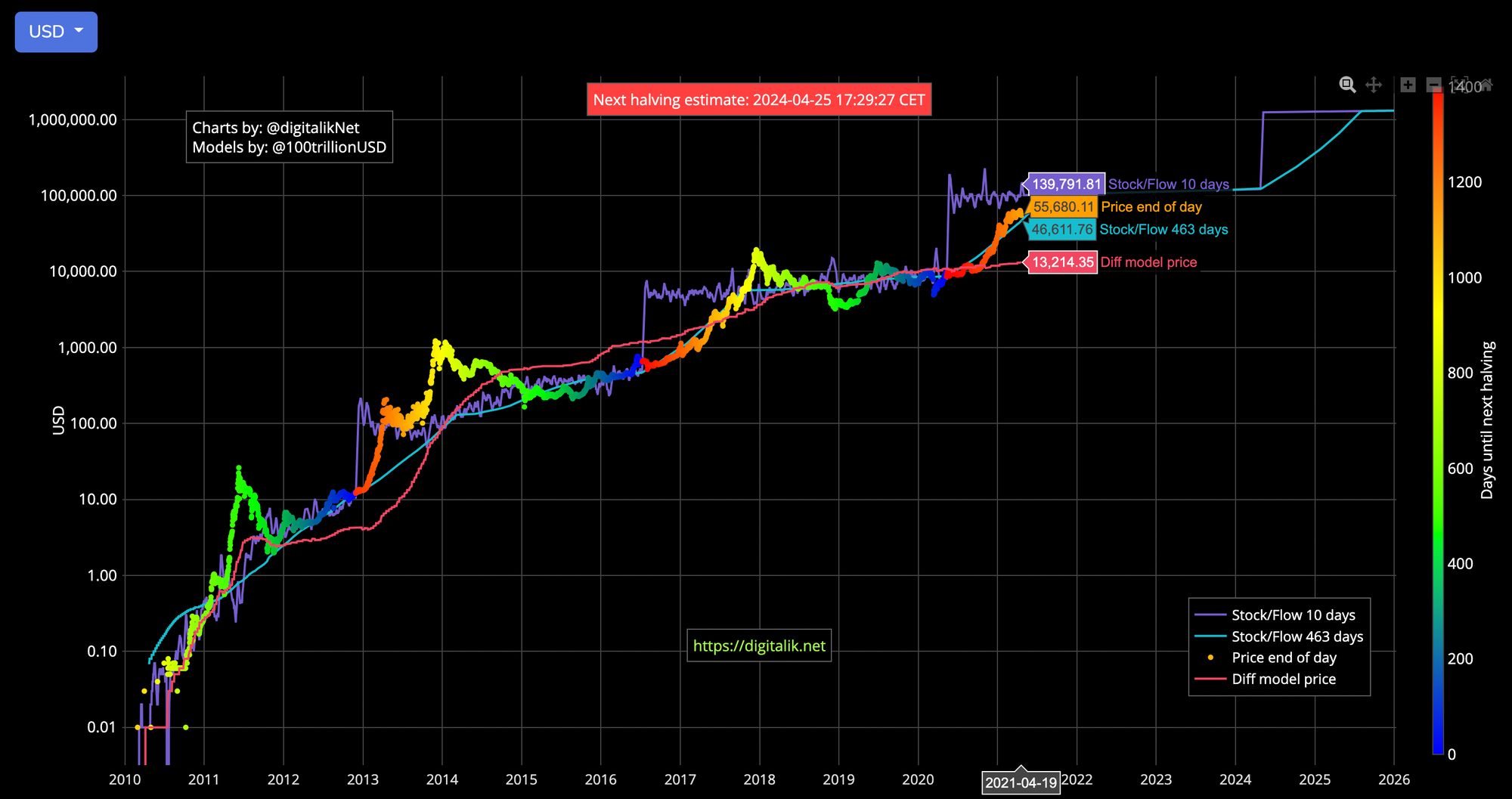

Plan B (Bitcoin): stock to flow (S2F) explained